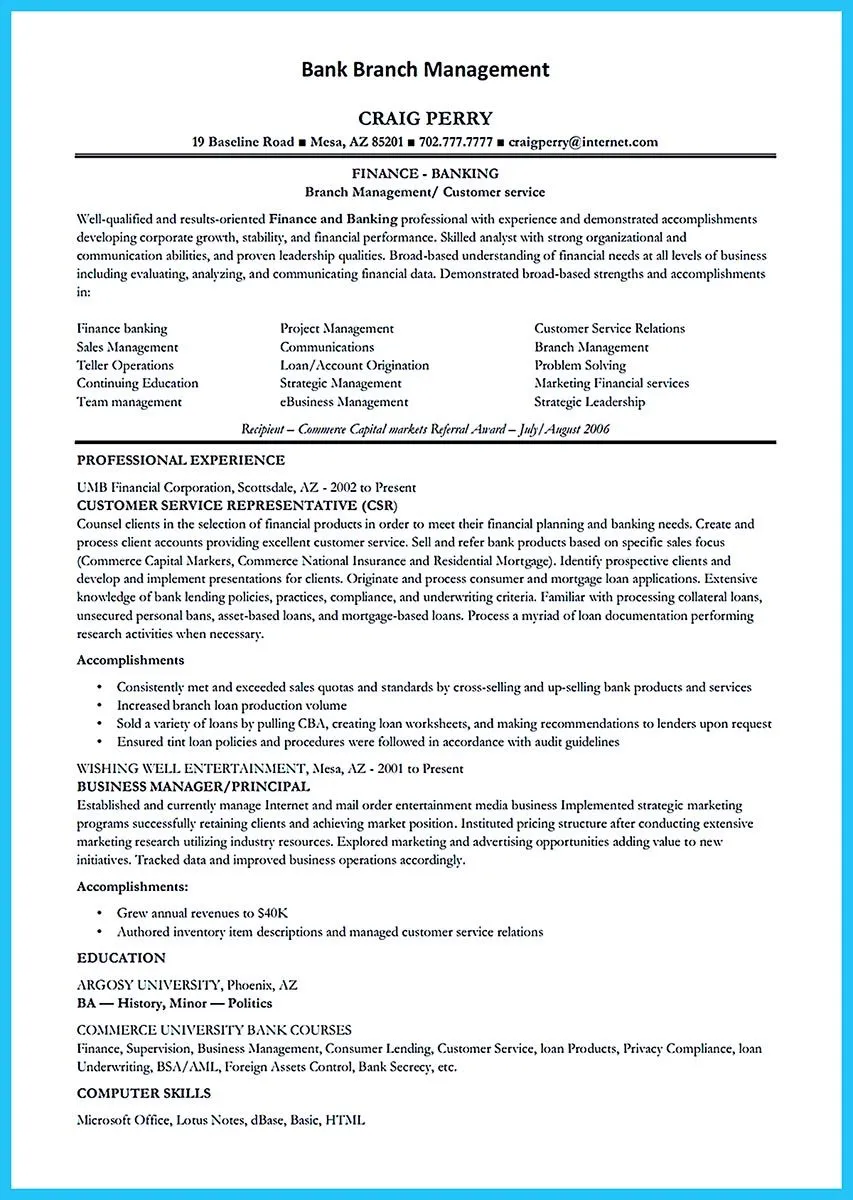

Understanding the Teller Role

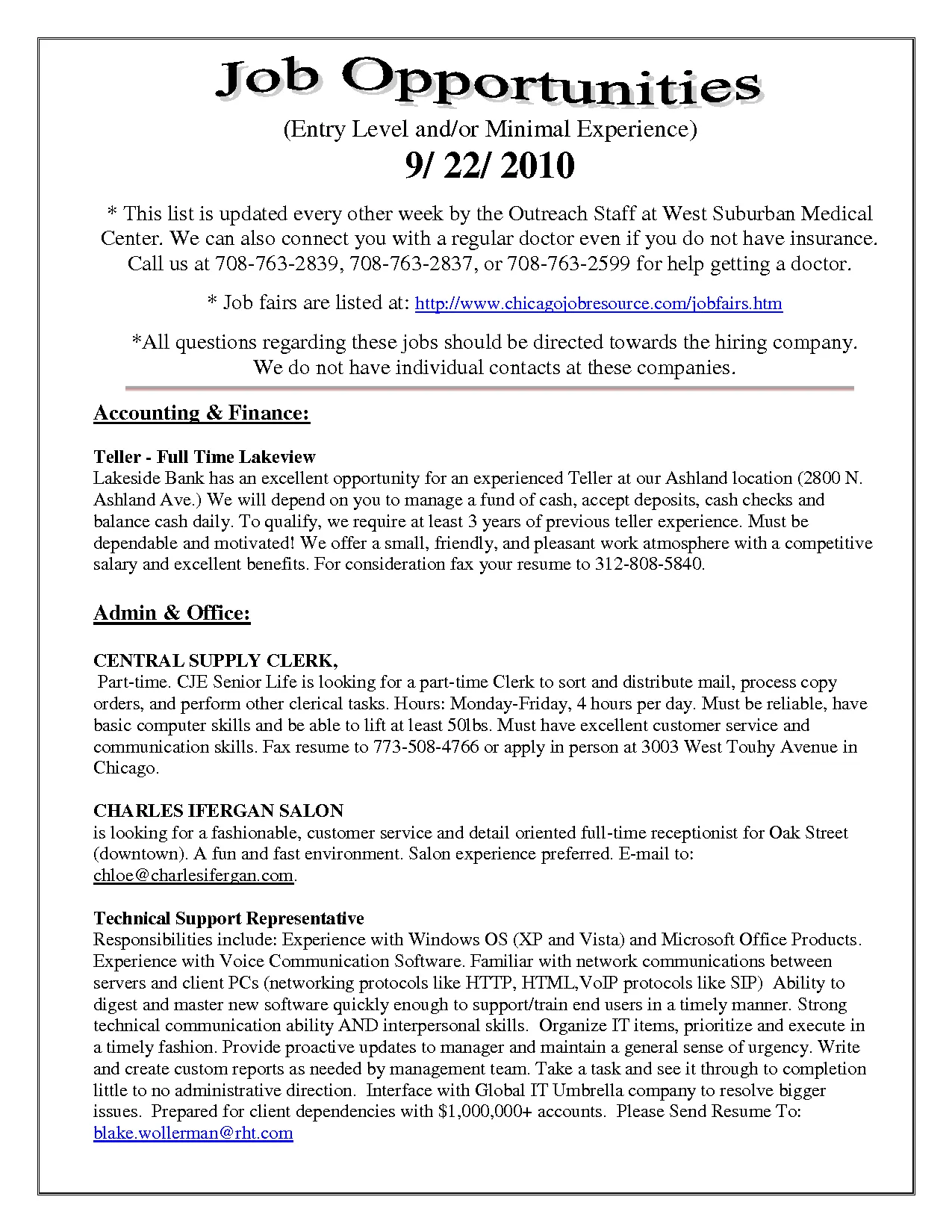

Before you begin crafting your cover letter, it’s essential to understand the role of a teller. Tellers are the face of a bank or credit union, providing essential services to customers. They handle financial transactions, such as processing deposits, withdrawals, and loan payments. They are also responsible for providing excellent customer service, answering customer inquiries, and promoting bank products. Understanding the core duties and responsibilities will help you tailor your cover letter to showcase your suitability for the position, even without direct experience. It shows you have a clear understanding of the job, demonstrating your initiative and eagerness to learn. This foundational knowledge will guide you in highlighting the skills and qualities that align with what banks seek in a teller.

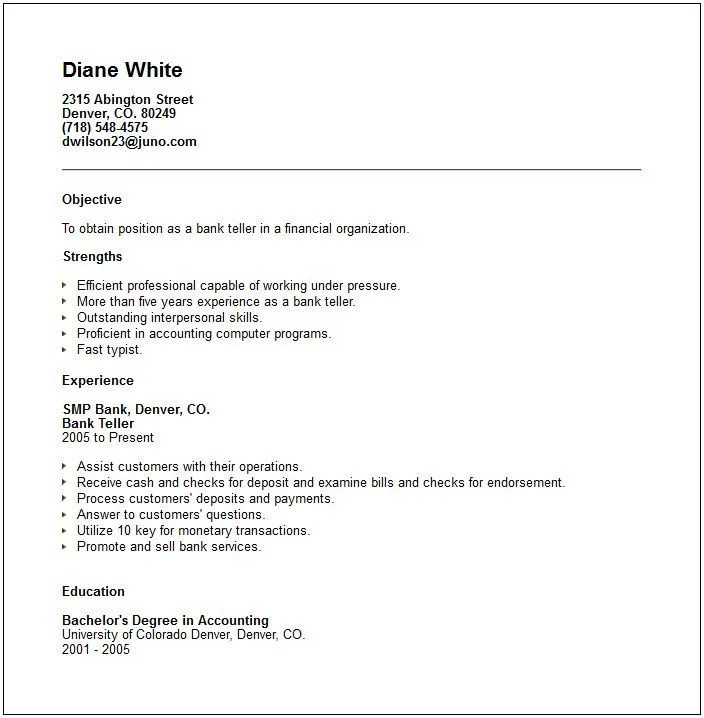

Key Responsibilities of a Teller

Teller responsibilities are diverse, encompassing customer service, financial transactions, and administrative tasks. Tellers process a high volume of cash and checks, balancing their cash drawers accurately at the end of each shift. They verify customer identification, answer customer inquiries about account balances and banking products, and resolve customer issues effectively. Furthermore, tellers often promote bank services, such as opening new accounts or applying for loans. They maintain detailed records of transactions, ensuring adherence to bank policies and regulatory requirements. Familiarizing yourself with these responsibilities will help you to align your skills in your cover letter, even if you do not have experience, you can highlight relevant transferable skills. Demonstrating awareness of these responsibilities will demonstrate that you have given the role serious consideration.

Skills Needed for a Teller Position

Although a teller position may not always require previous experience, it definitely does require the right skills. Core skills for a teller include strong communication, customer service, and mathematical abilities. Accuracy and attention to detail are crucial for handling financial transactions and balancing cash drawers. Proficiency in using computer systems and handling cash are also critical. Furthermore, tellers must possess strong problem-solving skills to address customer issues and handle unexpected situations. These skills are necessary to succeed in a teller position. These skills can be acquired through various means, such as educational pursuits, extracurricular activities, or volunteer work. Showcasing these skills in your cover letter makes your application stand out.

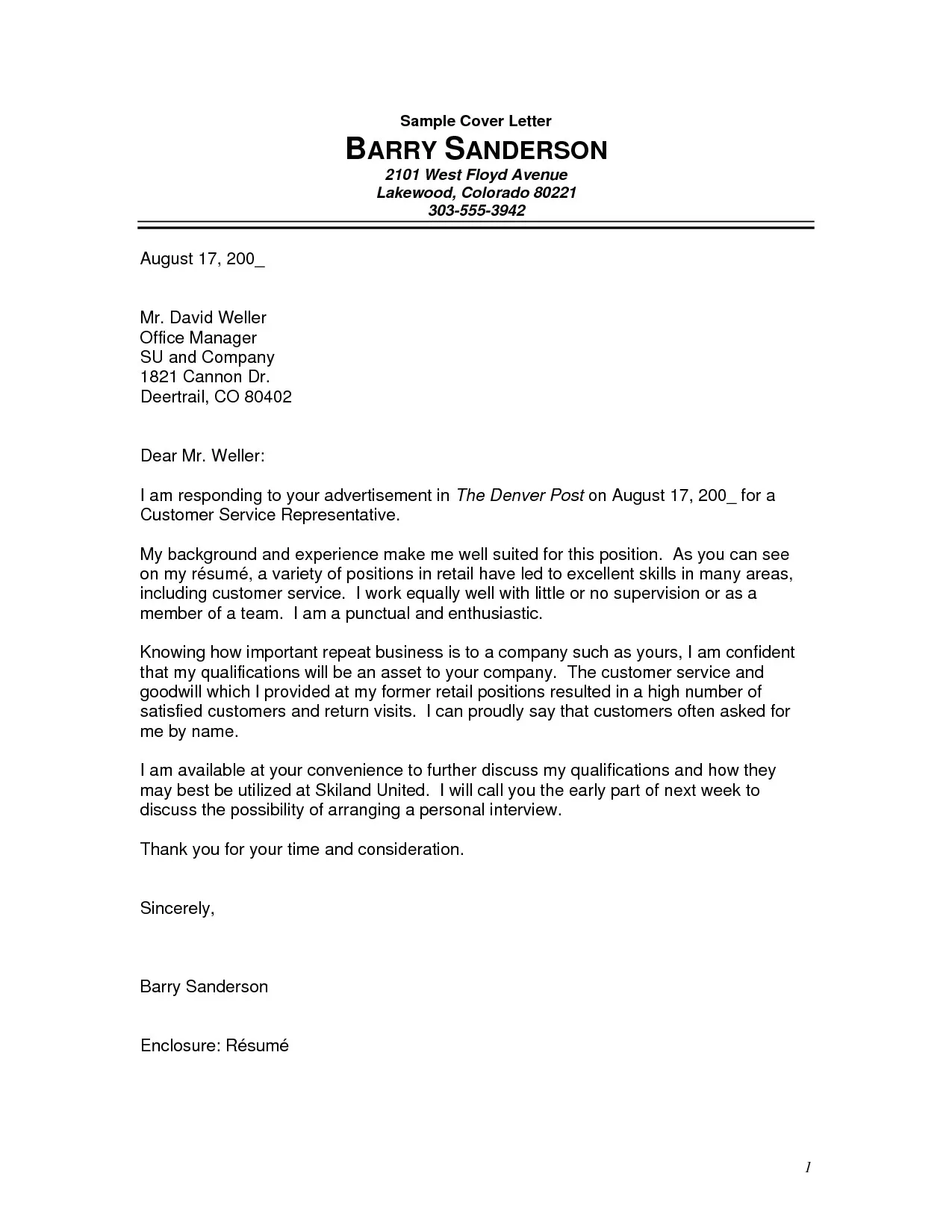

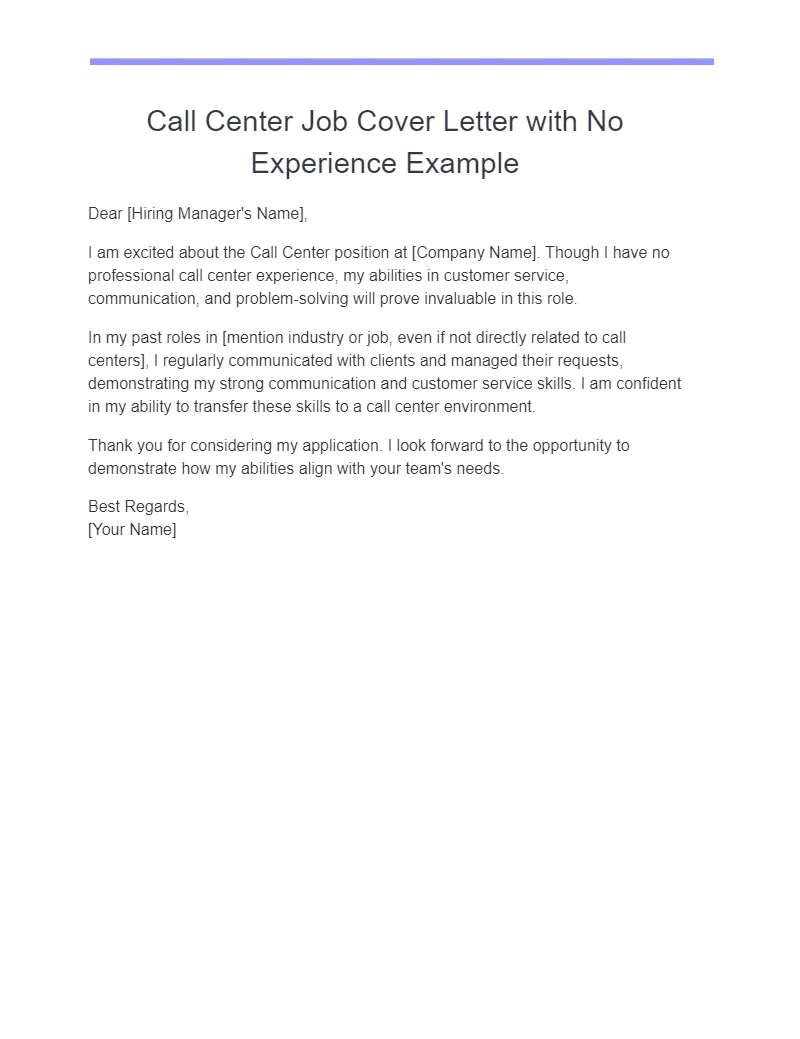

Crafting Your Cover Letter

Your cover letter is your opportunity to make a positive first impression and demonstrate why you are a good fit for the position. Your cover letter should be concise, professional, and tailored to the specific job requirements. Start with a strong opening paragraph that captures the reader’s attention and clearly states your interest in the position. Highlight your relevant skills and qualifications, even if you don’t have direct experience, and emphasize transferable skills like communication, customer service, and attention to detail. Use specific examples to illustrate your abilities, providing context and demonstrating how you have applied those skills in the past. This approach helps you create a compelling narrative about your abilities, and will significantly increase your chances of landing an interview.

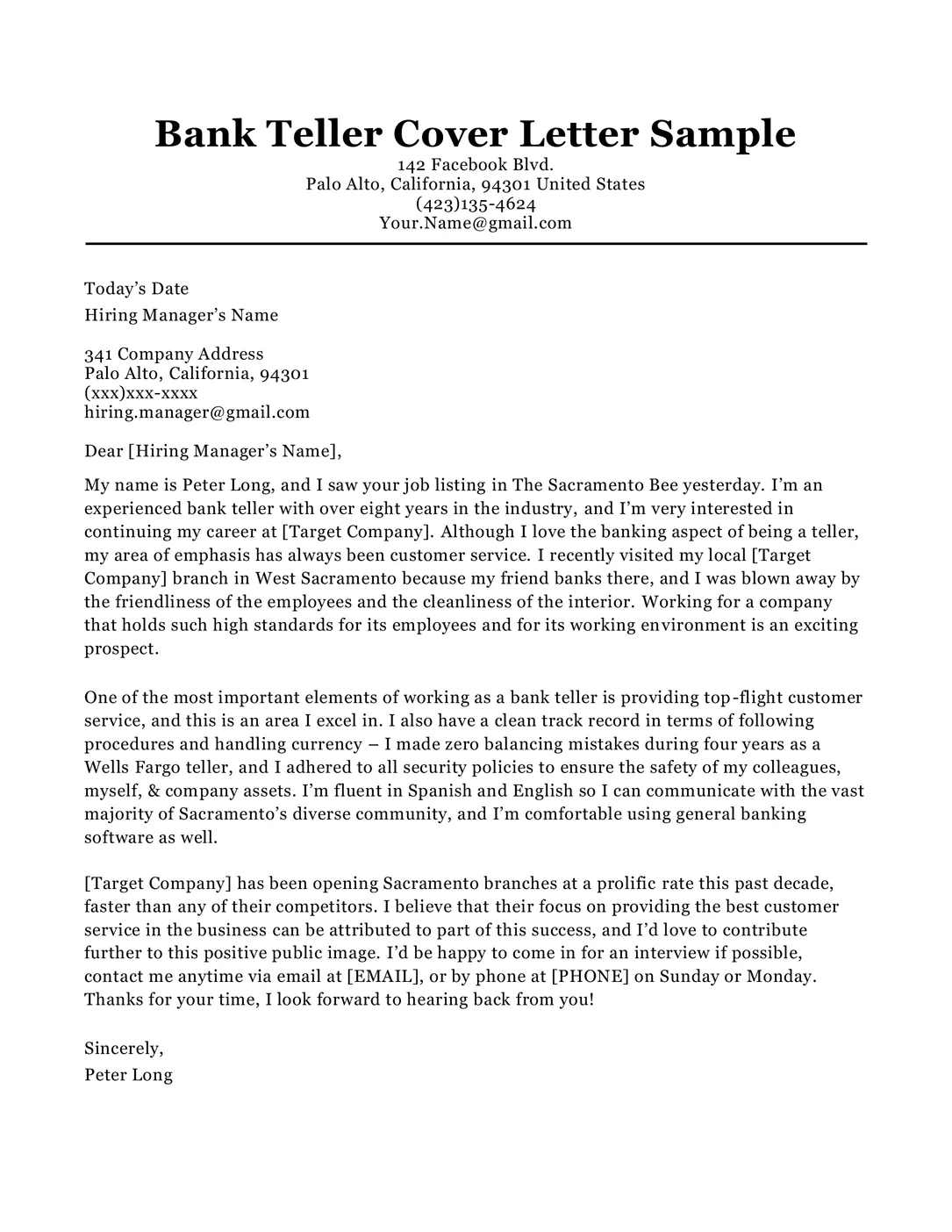

Header and Contact Information

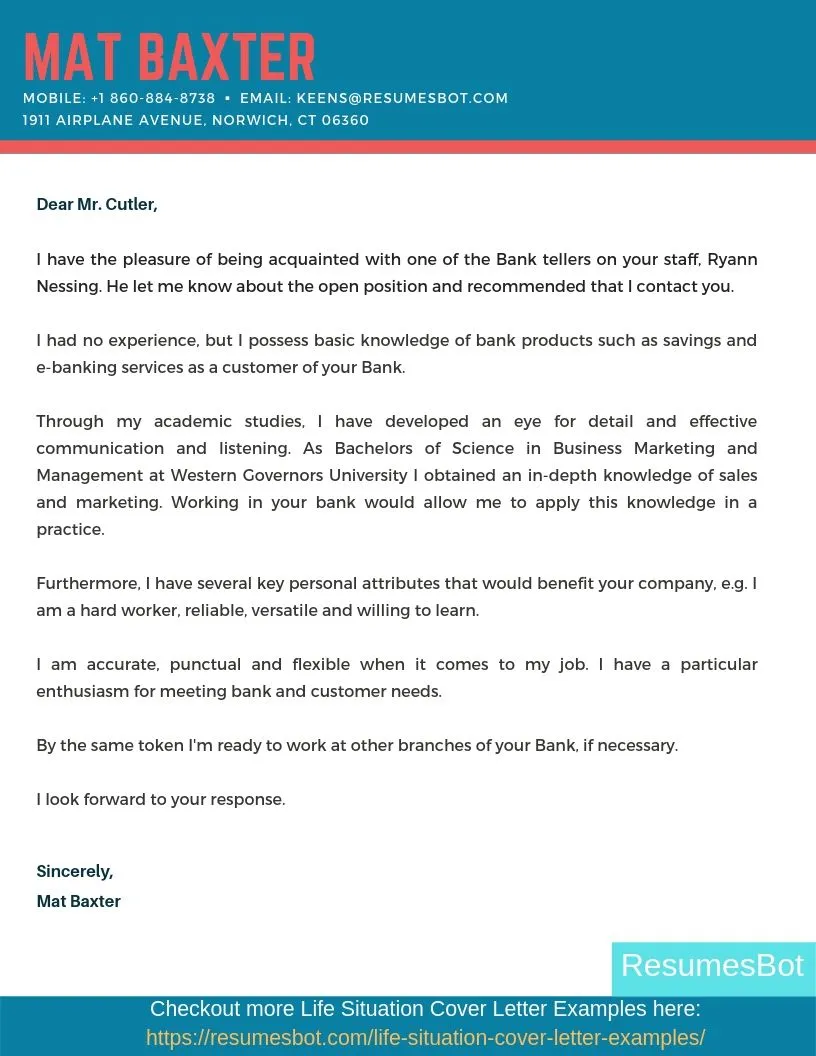

Begin your cover letter with a professional header that includes your full name, contact information (phone number and email address), and the date. If you know the hiring manager’s name, include it in the header, followed by their title and the bank’s or credit union’s name and address. This professional format shows that you’ve taken the time to tailor your application. Ensuring accuracy in this section is paramount; errors can easily disqualify your application. Proofread the header carefully to ensure all information is correct before submitting. A well-formatted header is the initial step in establishing your professionalism and attention to detail, which are critical attributes for a teller.

Personalized Greeting

Address the hiring manager by name to personalize your greeting, such as ‘Dear Mr./Ms. [Last Name]’. If the hiring manager’s name isn’t available, use a general greeting like ‘Dear Hiring Manager’. Personalizing the greeting demonstrates that you’ve researched the company and are genuinely interested in the position. Avoid generic greetings that may suggest a lack of effort or attention to detail. The right greeting establishes a positive tone and reflects your professionalism. It’s also a fantastic method to show respect and initiative. This demonstrates a proactive approach and adds a personal touch to your cover letter.

Opening Paragraph Highlighting Interest

The opening paragraph should immediately capture the reader’s attention and clearly state the position you are applying for. Express your enthusiasm for the role and the company. Briefly mention how you learned about the position and why you are interested in working there. If you have any prior interactions with the bank, such as being a customer or attending a career fair, mention them here. Start with a strong, concise opening that conveys your genuine interest and sets a positive tone for the rest of the letter. The goal is to immediately engage the reader and make them want to continue reading your cover letter, and an effective opening paragraph can set the stage for a successful application.

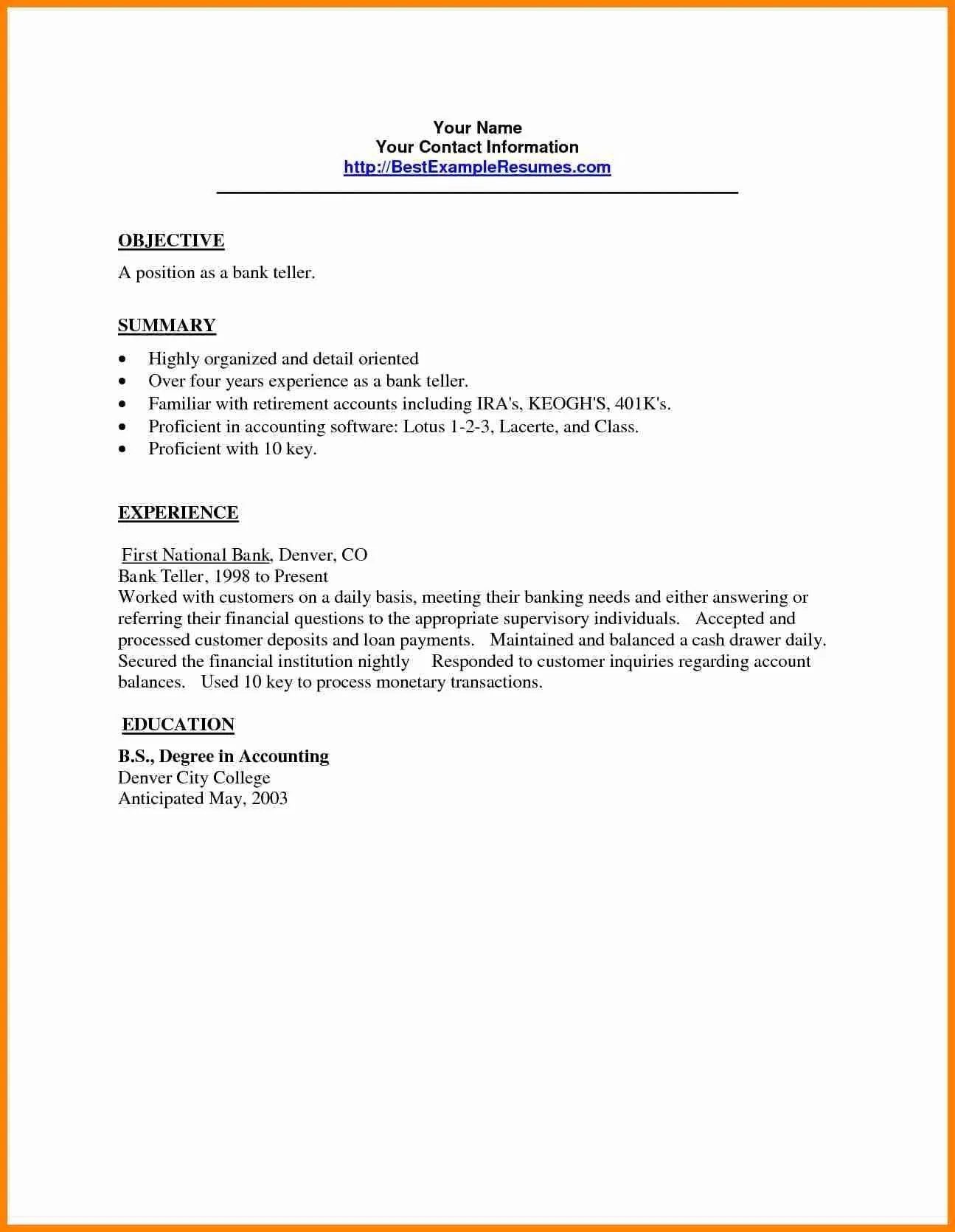

Body Paragraphs Showcasing Transferable Skills

The body of your cover letter is where you highlight your skills and qualifications. Since you have no experience, you must focus on transferable skills. Include customer service experience, even from retail or hospitality roles. Demonstrate your proficiency in communication, problem-solving, and attention to detail. Provide examples of how you’ve used these skills in other settings. For instance, describe a time when you successfully resolved a customer issue or handled a difficult situation. Highlight skills that align with the responsibilities of a teller, like handling cash, managing transactions, and balancing accounts. Explain how these skills transfer to the teller role and why you are a good fit for the position. Use keywords from the job description, such as ‘customer service’ and ‘accuracy’.

Highlighting Soft Skills

Soft skills are just as important as hard skills for a teller position. Focus on qualities such as excellent communication, a positive attitude, and the ability to work well under pressure. Highlight your interpersonal skills, emphasizing your ability to build rapport with customers and provide exceptional customer service. Mention your ability to work independently and as part of a team. Provide examples of how you’ve demonstrated these soft skills in past experiences. Highlight your organizational abilities. Emphasize your ability to manage time effectively, prioritize tasks, and handle multiple responsibilities simultaneously. These examples can significantly strengthen your case for the position, even without direct experience. Demonstrating these skills shows you are adaptable and can navigate the demands of a teller role.

Addressing the Lack of Experience

It’s crucial to address the lack of experience directly and positively. Acknowledge that you may not have direct experience but express your eagerness to learn and your strong interest in the role. Highlight your transferable skills and how they can be applied to the teller position. If you have any relevant training, coursework, or volunteer experience, emphasize these. Show that you are a quick learner and are committed to developing the skills needed to succeed. Mention your research on the bank and express your understanding of the teller’s duties and the banking industry. By addressing the lack of experience head-on, you demonstrate self-awareness and a proactive approach, which can mitigate any concerns the hiring manager might have.

Emphasizing Education and Training

If you have completed any relevant education or training, highlight it prominently. This could include a high school diploma or a college degree. Mention any courses that have prepared you for the role, such as accounting, business administration, or customer service. If you have completed any teller training programs, certifications, or workshops, be sure to list them in your cover letter. Even if your education isn’t directly related to banking, emphasize the skills and knowledge you’ve gained, such as your ability to learn new concepts, attention to detail, and problem-solving abilities. Education demonstrates your commitment to professional development and preparedness for the role, helping to reassure the hiring manager that you have the necessary skills to succeed.

Showcasing Relevant Coursework or Projects

If your education includes coursework or projects that are relevant to the teller position, highlight them in detail. Describe how your projects involved financial calculations, customer service, or cash handling. Even projects unrelated to banking can be relevant. Highlight skills like attention to detail, accuracy, and problem-solving skills. Explain the specific skills you’ve used and the outcomes of your projects. For example, detail how you handled customer transactions, managed funds, or solved problems. Showcasing these skills demonstrates your commitment to learning and preparing for the role. Providing concrete examples helps employers understand your abilities and potential contributions.

Closing the Cover Letter

The closing paragraph is your opportunity to express your enthusiasm and gratitude. Reiterate your interest in the position and the company. Thank the hiring manager for their time and consideration, and include a call to action that encourages them to contact you. This reinforces your commitment and leaves a positive impression. Maintain a professional tone and avoid generic phrases. A well-crafted closing paragraph is the final step in showcasing your personality and enthusiasm for the position.

Expressing Enthusiasm and Availability

Reiterate your enthusiasm for the position and express your interest in the opportunity. Let the hiring manager know that you are available for an interview at their earliest convenience. Be sure to mention your flexibility and eagerness to discuss your qualifications further. This demonstrates your genuine interest in the role. Expressing your eagerness to meet and discuss your qualifications personally shows your desire to learn more about the opportunity. Make sure you’re readily available to respond to their requests, so they have an easy path to contacting you. This is a crucial element in closing your cover letter and maximizing your chances of moving forward.

Call to Action Encouraging Contact

Include a clear call to action that encourages the hiring manager to contact you. Provide your phone number and email address. State your willingness to provide any additional information or answer any questions they may have. Encourage them to reach out to you via phone or email. You can also suggest a specific time for the interview. This direct approach ensures the hiring manager knows how to proceed and increases your chances of getting an interview. Including a direct call to action ensures you have the final opportunity to connect, increasing the likelihood of securing the interview and ultimately the job. This simple step is essential to a successful cover letter.

Formatting and Proofreading

Proper formatting and proofreading are essential for creating a professional cover letter. Your cover letter should be easy to read and visually appealing. Correct grammar and spelling are crucial to make a positive impression. Poorly formatted or error-filled letters can undermine your credibility, so take the time to get it right. By focusing on this, you demonstrate attention to detail and commitment to the application process.

Formatting Guidelines

Use a standard font, such as Times New Roman or Arial, in a size between 10 and 12 points. Use one-inch margins and single-space the text. Ensure a clean and organized layout with clear paragraphs and headings. Use bullet points to highlight your skills or experiences. Keep the letter concise and to the point. A well-formatted cover letter is easy to read and demonstrates professionalism. Following these guidelines creates a positive impression, which is crucial. Formatting is essential for readability and showcases your attention to detail. These are essential steps in presenting your application.

Proofreading for Errors

Before submitting your cover letter, carefully proofread it for any errors in grammar, spelling, and punctuation. Errors can damage your credibility and make a negative impression. Read the letter aloud to catch any awkward phrasing or typos. Ask a friend or family member to review it. Use a spell checker. Proofreading shows your attention to detail and commitment to professionalism. Reviewing the letter helps ensure that your skills and abilities are conveyed correctly, so take your time and double-check your work. Thorough proofreading is an essential step in creating a strong, professional cover letter.

Tailoring Your Cover Letter

A generic cover letter will not make a positive impression. Tailor your cover letter to each specific job you apply for. Research the company and the specific job requirements. Use keywords from the job description. Emphasize the skills and experience that are most relevant to the position. Customize your cover letter to showcase your understanding of the company’s values and goals. Show that you have taken the time to understand the position. This will enhance your chances of standing out and making a positive first impression.

Researching the Bank or Credit Union

Before writing your cover letter, research the bank or credit union you are applying to. Visit their website and learn about their products, services, and values. Read recent news articles and press releases about the bank. Identify their target market and how they position themselves in the financial market. Understanding the company’s culture can help you tailor your cover letter and demonstrate your interest in the company. This will help you personalize your letter and align your skills and experience. Showing your understanding of their mission demonstrates your commitment to the role. Doing this kind of research shows that you’re truly invested in the opportunity.

Matching Skills to Job Requirements

Carefully review the job description and identify the required skills and qualifications. Align your skills and experience with these requirements. Use the same keywords from the job description in your cover letter. Provide specific examples of how you have demonstrated these skills in the past. If the job description emphasizes customer service, highlight your customer service experience. Tailoring your cover letter to the job requirements will help you demonstrate that you are a good fit. By doing this, you demonstrate to the hiring manager that you understand what the role entails. Highlighting the skills that meet their requirements shows the hiring manager that you have the right qualifications for the role.

Tips for Submitting Your Application

Submitting your application correctly is just as important as writing a strong cover letter. Follow the application instructions carefully, including all requirements and deadlines. Proofread your application before submitting it. Ensure that your resume and cover letter are formatted correctly and free of errors. Confirm that all required documents are attached. Following instructions demonstrates attention to detail and respect for the hiring process. A well-prepared submission will increase your chances of making a favorable impression and securing an interview.

Following Application Instructions

Carefully read the job posting and application instructions. Note any specific requirements or guidelines. Ensure that you include all required documents, such as your resume and cover letter. Follow the formatting guidelines provided by the employer. Submit your application by the deadline. Failing to follow the application instructions could lead to your application being rejected. Following instructions ensures that your application is considered. This is an important step in maximizing your chances of being considered for the position. It shows that you respect the hiring process.

The Interview Process

If your cover letter is successful, you will be invited for an interview. Prepare for the interview by researching the company and practicing your answers to common interview questions. Dress professionally and arrive on time. Prepare questions to ask the interviewer. The interview is your opportunity to further demonstrate your skills and qualifications. Being prepared for the interview significantly increases your chances of success. A well-prepared interview will show you as a strong candidate. It’s an important step in showing your qualifications and earning the job.

Preparing for the Interview

Before the interview, research the company thoroughly and anticipate potential questions. Practice your answers to common interview questions, such as ‘Tell me about yourself,’ and ‘Why are you interested in this position?’. Prepare questions to ask the interviewer to show your interest and engagement. Plan your outfit to reflect professionalism. Be punctual and arrive early. Bring copies of your resume and any other supporting documents. Preparing thoroughly will increase your confidence and help you make a positive impression. These actions demonstrate your enthusiasm and preparedness. Being well-prepared shows you are invested in the opportunity.